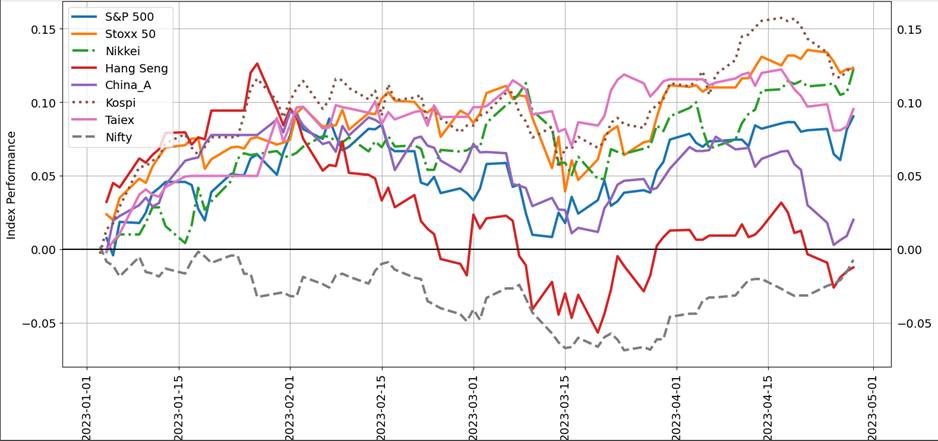

During the previous week, global stock markets predominantly concluded on a positive note, with the United States leading the way, driven by stronger-than-anticipated earnings from major technology firms. The MSCI All Country World Index showed minimal changes, while the US dollar index remained relatively stable.

In the equity markets, the S&P 500 experienced a weekly increase of 0.87%, while the Nasdaq 100 index surged by nearly 2%. The German DAX 40 registered a gain of 0.3%, whereas the UK FTSE 100 witnessed a decline of 0.6%. On the other hand, Japan's Nikkei 225 rose by 1.0%, while the Hang Seng index in Hong Kong experienced a decrease of 0.9%.

Based on Bloomberg data, approximately half of the companies in the S&P 500 that have released their earnings reports have shown a sales surprise, 66% have reported higher-than-expected sales.

80% of these companies have reported earnings that exceeded expectations.

FactSet data indicates that in the upcoming week, 162 companies in the S&P 500 are scheduled to announce their first-quarter results.

Economic data released this week shows that the US economy experienced a greater-than-expected slowdown in the first quarter, while the Euro area economy exhibited minimal growth during the same period.

Despite the economic challenges, there is a widespread expectation that both the US Federal Reserve and the European Central Bank (ECB) will implement a 25 basis points (bps) interest rate hike at their respective meetings on May 3 and May 4.

The central banks' response will depend heavily on the evolution of growth and inflation dynamics in the upcoming months, as these factors play a crucial role in shaping their decision-making process.

Source – Bloomberg

In the coming week, the release of global manufacturing and services data is anticipated to provide inputs into global economic activity.

This is particularly significant for the United States, where there is no formal consensus regarding whether the economy will experience a soft landing, hard landing, or no significant changes.

Furthermore, the extent and pace at which global inflation cools down will be important in shaping market expectations, particularly in regards to central banks' policy shifts.

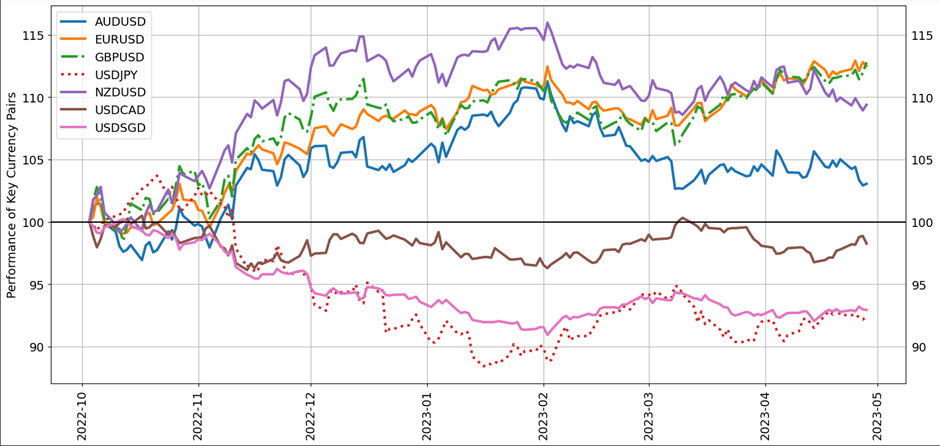

Considering that Australian inflation slowdown in the first quarter, it is expected that the Reserve Bank of Australia (RBA) will maintain its interest rates at 3.6% during its meeting on Tuesday.

The RBA had previously kept rates unchanged in April but had left the possibility open for a rise in future.

Source – Bloomberg

The upcoming week will see the release of several significant data points related to global manufacturing and services activity.

This includes the recently published China NBS manufacturing PMI and non-manufacturing PMI for April. On Monday 1st May, the US ISM manufacturing PMI for April will be reported, followed by the Reserve Bank of Australia's (RBA) interest rate decision and Euro area inflation data for April on Tuesday.

On Wednesday, 3rd May, the Reserve Bank of New Zealand (RBNZ) will publish its Financial Stability Report along with New Zealand's jobs data for Q1. Additionally, the US ISM services PMI data for April and the interest rate decision by the US Federal Reserve are scheduled for Wednesday.

On Thursday, the European Central Bank (ECB) will announce its interest rate decision. Followed by the US jobs data for April and Euro area retail sales data for March on 6th May (Friday).